How Do Tax Brackets Work?

- Patrick Phippen

- Mar 7, 2023

- 4 min read

Updated: Apr 24, 2023

One of the most commonly misunderstood tax concepts is how tax brackets work. Fortunately, this is a concept that is easy to grasp once you have the right information.

A hypothetical married couple expecting to earn $85,000 combined in 2023 might say they are in the “12% tax bracket.” What, exactly, does that mean? Will they pay $10,200 ($85,000 × 12%) in federal income tax?

No. Assuming that hypothetical couple has no other income and claims the standard deduction, they will pay $6,436 in federal income tax. While their marginal tax rate is 12%, their effective tax rate is only 7.6%.

Your marginal tax rate, which people typically reference as their “tax bracket,” is the rate you will pay on your next dollar earned. Your effective tax rate is your actual tax liability ($6,436 in the above example) divided by your total income ($85,000 in the above example), expressed as a percentage; it is the average rate that applies to all your income. The common mistake that folks often make is conflating the two, i.e., thinking that their “tax bracket” is the tax rate that applies to all their income.

What does “marginal tax rate” even mean, anyway?

Think of marginal tax rates like climbing stairs. The first portion of income is taxed at a certain rate, then the next portion of income is taxed at a higher rate, and the trend continues as you ascend the staircase. Here are the 2023 marginal federal income tax rates for individuals, based on filing status and taxable income:

(The above figures apply to 2023 tax returns that will be filed in early 2024. They are inflation-adjusted from the 2022 tax rates that apply to returns being filed now. I chose to use 2023 rates in this article since they will be the ones that apply when doing forward-looking tax planning.)

Filing status is a topic for another day, but suffice it to say that you should use the filing status that is most advantageous if you qualify for more than one. The IRS has a handy tool to help you, but the advice of a trusted tax adviser is always best!

Your taxable income is your total income minus deductions. Rather than itemize deductions (i.e., list out mortgage interest, property taxes, charitable contributions, etc.), most taxpayers will simply take the standard deduction. Your standard deduction depends on your filing status. For 2023, the standard deduction is:

Married filing joint / qualifying widow(er) = $27,700

Head of household= $20,800

Single = $13,850

Married filing separate = $13,850

Example 1

Our hypothetical married couple filing a joint return for 2023 with $85,000 in combined income and claiming the standard deduction will have taxable income of $57,300 ($85,000 – $27,700). Using the marginal tax rates above, how is this $57,300 taxed?

Step 1. In the married filing joint column, we stay in the first row up to $22,000. This means the first $22,000 is taxed at 10%, so we have $2,200 in tax ($22,000 × 10%) for this step.

Step 2. We stay in the second row up to $89,450. Since our taxable income is lower than this, the second row is our final step. The first $22,000 has already been taxed. The remaining amount ($57,300 – $22,000 = $35,300) is all that gets taxed here. We have $4,236 in tax ($35,300 × 12%) at this step.

Adding the steps together, we have $2,200 + $4,236 = $6,436 in tax. (Tax credits* might further reduce the tax bill, but that is beyond the scope of this article.)

Putting it all together, the total income earned by our hypothetical couple can be broken into three groups:

This couple’s tax liability ($6,436) is 7.6% of their total income ($85,000), so 7.6% is their effective tax rate. They need to have more than 7.6% of their paychecks deducted for federal income tax to receive a refund at the end of the year.

Since this couple is in the 12% tax bracket, 12% is their marginal tax rate; any additional income they might receive in 2023 will be taxed at 12% or higher. If they receive an unexpected windfall in December, for instance, they should set aside at least 12% of it for federal income tax.

Example 2

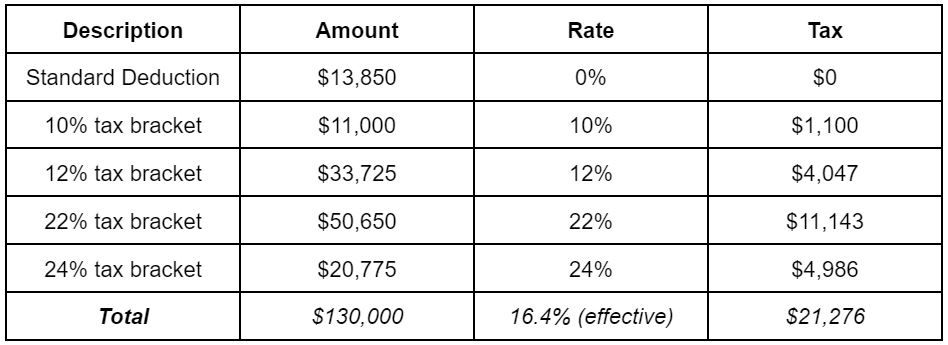

For our second example, consider a single person with $130,000 of total income who will claim the standard deduction for 2023. (Remember, right now you are filing tax returns for 2022.)

Climbing the stairs, how much is taxed at each step?

Step 0. Since the "single" standard deduction is $13,850 for 2023, their taxable income is $116,150 ($130,000 – $13,850), landing them in the 24% tax bracket.

Step 1. Taxable income exceeds $11,000, so the first $11,000 is taxed at 10%.

Step 2. Taxable income exceeds $44,725, so the next $33,725 ($44,725 – $11,000 already taxed in Step 1) is taxed at 12%.

Step 3. Taxable income exceeds $95,375, so the next $50,650 ($95,375 – $44,725 already taxed in Steps 1 and 2) is taxed at 22%.

Step 4. Taxable income is less than $182,100, so this is our final step. The final $20,775 ($116,150 – $95,375 already taxed in Steps 1, 2, and 3) is taxed at 24%.

This person’s tax liability ($21,276) is 16.4% of their total income ($130,000), so 16.4% is their effective tax rate. They need to have more than 16.4% of their paychecks deducted for federal income tax to receive a refund at the end of the year.

Their tax bracket, or marginal tax rate, is 24%, so any additional income received (up to $182,100 in taxable income) will be taxed at that percentage. Any late-year windfalls should have 24% set aside for federal income tax.

What about my state rates?

The same logic applies to state tax brackets as well, just with different deduction amounts, bracket rates, and cut points.

What do I really need to know?

If this all makes your head spin, just remember this: Your tax bracket is the rate that applies on your next dollar earned, not on all your dollars earned. Your effective tax rate will be lower.

One more goodie: for taxable incomes below $100,000, the IRS has published tables with the computations already performed! See pages 63 through 74 of the 2022 Form 1040 Instructions. For taxable incomes of $100,000 and above, the IRS has charts that walk you through the above steps on page 75. The 2022 tax rates are on page 109.

* A deduction reduces taxable income. Tax is then computed as a percentage of taxable income. A credit directly reduces the tax itself, dollar-for-dollar.

Comments